WISeKey International

Holding AG-Interim

Report 30 June 2020 FINAL

Contents

Introduction

- CEO Letter to Shareholders

- WISeKey Digital Transformation Plan 2020 – 2025

- First Half 2020 Operational Milestones

- First Half 2020 Financial Milestones

WISeKey – products and services

Recent Agreements

2020 Growth Opportunities

- Solutions for a shifting cybersecurity market landscape

- Foresight Platform

Recognitions

Management Discussion and Analysis

Financial Report

Introduction

CEO Letter to Shareholders

Dear shareholders,

During the first 6 months of 2020 we continued making significant progress towards achieving our primary objective of building WISeKey to be a globally competitive and profitable company. That said, the COVID-19 global pandemic substantially affected our second quarter and first half 2020 operations and financial results. Our semiconductors deliveries decreased as compared to a year ago despite the higher demand for our semiconductors and cybersecurity offerings in new market segments like drones and home appliances.

COVID-19 shutdown has significantly altered the fundamentals of the semiconductors and IoT sector, including customer behavior towards developing inventories, directly affecting production by creating supply chain and market disruption, resulting in reduction of business revenues in key sectors for WISeKey such as luxury and in particularly high-end watches. Many companies around the world are facing an unclear future, as their survival is depended on potential government interventions, while others may not survive the current crisis; this difficult situation has made it impossible for us to project revenue and give guidance.

As consequence consolidated revenues for H1 2020 was $8.0 million, a decrease of $4.4 million (36%) in comparison of H1 2019, driven by the difficult market environment impacting the semiconductors sector as many manufacturers of product secured by WISeKey reduced their inventories (watches, routers, cars) with around 45% fewer deliveries year-on-year. This decrease was partly offset by new sales in products such as Drones and Medical products. To protect future revenue, we have made significant investments in high growth future revenue segments such as brand protection and adding new technologies to our platform such as Data, Blockchain and AI, and taking minority ownerships in startups and current market leaders of these technologies.

Despite the negative affect of COVID-19, the Group has not had to make any reductions in work force and has only requested government support for a small percentage of its employee salaries.

We announced the establishment of a Joint Venture with arago, a leading AI company in Germany to make a strategic investment that will allow us to integrate AI into our platform strengthening and bringing new sources of revenue for WISeKey. As consequence we have calibrated the business and launched a digital transformation plan of five years to face the new market environment on an industrial basis and the company is now working in line with the new plan. It is our ambition to maintain the current cash reserve level of $16 million as operational cash and raise capital if required to fund acquisitions and strategic participations. During a time when the entire industry and in particular medium size companies face a difficult situation with uncertainty, WISeKey is well positioned to navigate these challenging times, take advantage of opportunities that arise from this situation and successfully overcome this global crisis.

Investing in our Future

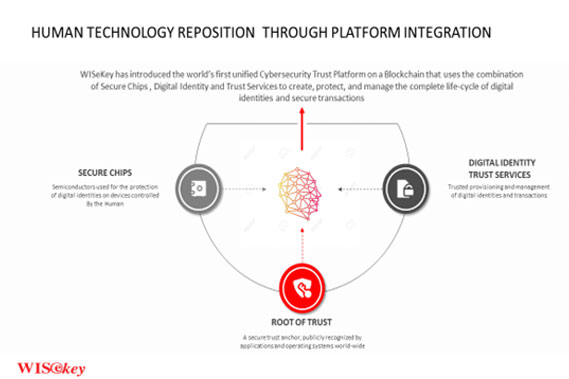

I would like to highlight our continued commitment to invest in our cybersecurity / IoT/AI businesses for the future. Together with our JV partners we will be spending approximately $30 million on capital expenditure during the next three years using signed financing facilities with Nice and Green, Crede and Long State Investment Limited to become one of the leading providers of semiconductors, IoT and Blockchain services. The Managed WISeKey Root of Trust (“ROT”) is a major asset for growth and serves as a common trust anchor, which is recognized by all operating systems and applications to ensure authenticity, confidentiality and integrity of online transactions. With the Cryptographic ROT embedded on a device, the IoT product manufacturers can use code signing certificates and a cloud-based signature-as-a-service to secure interactions among and between objects and people.

Furthermore, I would to thank the board, management and our employees for their dedication but most importantly the sacrifices they made and continue to make during the COVID-19 crisis. I am proud of our team and their continuous commitment in making WISeKey a competitive company.

Sincerely Yours,

Carlos Moreira

Founder, Chairman and CEO of WISeKey International Holding

September 8, 2020

WISeKey Digital Transformation Plan 2020 – 2025

Four years ago, after our Swiss Listing in April 2016, we set out to build the foundation to transform WISeKey into a company that will lead our customers’ digital transitions. Now, after 2 acquisitions and technology integration, we are reinventing our cybersecurity/IoT architectures designed to deliver a cost effective, simple and secure value proposition to help our customers succeed. At the same time, we continue to explore ways to expand our platform with the objective to provide solutions to some of the world’s most pressing digital transformation problems.

Digital transformation is one of the key priorities of WISeKey who are developing disruptive technologies and solutions to overcome key challenges in a complex world and to unlock new growth opportunities.

The scale of impact for disruptive technology adoption on businesses has never been more apparent than now, as the technology is required and can be harnessed with unique applications to even help contain the spread of COVID-19. All of WISekey technologies, starting from Digital Identities and Semiconductors, to cloud-based services and cybersecurity solutions, have become the lifeline of businesses irrespective of their size or industry sector.

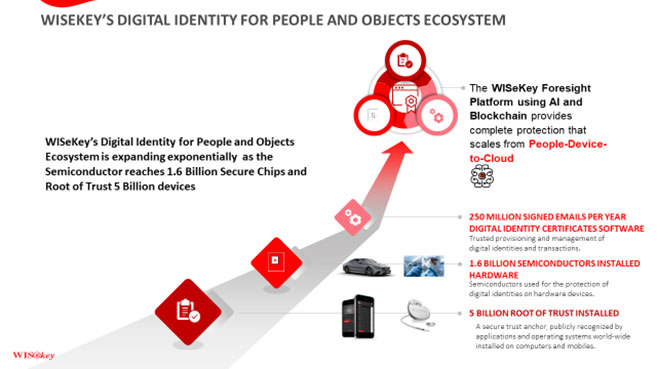

WISeKey currently provides cybersecurity and IoT solutions to several of the world’s most successful business and consumer brands. Everyday, thousands of customers use the 1.5 billion WISeKey-based chips in products that connect people, secure objects and enhance the interactions of machines with humans.

The WISeKey IoT network of interconnected systems and advances in digital certification, data analytics, artificial intelligence (AI) and ubiquitous connectivity, are the pillars of the Digital Transformation process the company has started this year. With the objective to diversify its revenue generation through unique and fully integrated market solutions, WISeKey will leverage the foundation it has been built as well as its experience, and domain expertise to evolve the overall business, culture and organization.

Our strategy is aligned to the ever-increasing needs of our customers in what addresses to the broader cybersecurity needs.

As we continue to build a highly trusted, secure platform and related solutions portfolio, there are eight core elements in our digital transformation that we are focused on: cybersecurity, Digital Identity, IoT, mobile applications, data, cloud, blockchain and AI.

Building upon the unique position and foundation which has been put in place, the process has started during the first half of 2020 by recruiting new senior sales management in USA, Germany, France, and Japan under the supervision of our new global Chief Revenue Officer located in USA who is in charge continuing the sales and marketing evolution and finding new ways to support the next phase of our grow strategy with more profitable ways of generating more sales and increased profitably, in less time.

Every investment we make and every product and service we build fits within one of these categories and constitutes the core of our digital transformation plan from 2020 to 2025.

To support the sales process, WISeKey’s team has been focused on:

- identifying the right customers and partners for our technology while leveraging existing wins to educate the sector on which they operate (e.g Drones),

- targeting the most mature and profitable territories,

- identifying the most effective sales staff,

- connecting with the right customers and channels, and

- understanding the best ways to close sales while advancing our knowledge on the best factors which can influence performance across the sales cycle.

We broadened our offerings to reach new audiences, such as bringing WISeID technology to the fight of COVID-19 with the development of spacelab editions such as WIShelter and WISeTravel protecting users during the pandemic. We took collaboration to a new level with Zoom allowing our staff and customers to share webinars, conversations and content together in a digital environment.

It’s also very clear to us that with the size of our company and the strong competition in this sector, we need to cooperate with dominant platforms, as no one company can deliver the full breadth of technology solutions that customers need, at the pace the market requires and trust is becoming the essential asset that these platforms require. We believe that building strategic partnerships will be as important in driving customer value and future growth as mergers and acquisitions have been over the past decade.

Since we started our digital transformation, we announced next-generation strategic partnerships with market leaders in their fields.

With IBM Watson on AI, SAP on IoT, Microsoft on Cloud and TechAccord and Oracle on blockchain, we intend to build the infrastructure and solutions we require for our, and the world’s, digital transformation.

WISeKey’s strategic investment in arago in August 2020 will reinforce our technology and market position in the Artificial Intelligence (“AI”) space. The direct impact of ARAGO’s AI and data technology, will bring new revenue sources for WISeKey’s Digital Transformation strategy as:

- Human knowledge is normally hard to incorporate in digital processes without UX problems. With the HIRO™ problem solving engine, the ability to capture human expertise and scale decision processes becomes available to any application built on top of the platform. This is the only way to apply experience in billion-device IoT scenarios.

- Scaling is normally a huge effort after getting things to work. The arago micro service environment allows immediate deployment of individualized services to an auto-scaling 24/7 operating platform making specialized services scalable in no time.

- Agile and reliable development of any business use-case depends on a stable environment. arago’s API layer hides the complexity of a PB sized data processing environment from developers and customers, allows detailed rights management and ensures top performance.

- Having a scalable data backend is the key to any data-driven business. arago’s knowledge core can handle semantic, time-series and blob data at petabyte scale and has necessary compliance and security features for regulatory and enterprise operations. WISeKey’s IoT business is expanded to data driven solutions immediately.

The increasing adoption of AI and IoT convergence is one of the primary factors that is driving the growth of the market. During the last five years, a rapid surge in the adoption of AI IoT cloud services has been witnessed. It is driven by its capabilities to provide enterprise wide array of resources they can utilize to scale, orchestrate, and support their operations.

Additionally, we are planning to form a Joint Venture with the name WISeAI that will be adding secure AI cloud services from Switzerland in cooperation with arago, using Swiss data centers and Swiss Alps Mountain bunkers to store the personal data generated by users and enterprises. WISeKey, is the first e-security company in the world to offer decentralized Trust Models and PKI architectures. In addition, WISeKey allows data ecosystems to be federated via a unique digital identity, enabling users to interact while maintaining control of their personal data. Users have the have the freedom to choose where their data resides and who is allowed to access it. By decoupling content from the application and digital identity itself, users will be able to use their data as currency and develop digital data dividends-based solutions as consumers have a right to know and control how their data is being used and to be able to monetize their data (www.wiseid.com).

With all of this in place, in fiscal 2020 we continue to focus on our strategic priorities and digital transformation plan as we aim to best position ourselves to drive revenue growth regardless of the current market conditions. We are excited to build on the momentum we have generated over the last 6 months and for the opportunities that lie ahead.

WISeKey is teaming with several leading partners (https://www.wisekey.com/partners/)

for the development of an IoT Early Warning System (EWS) designed with the

objective of saving lives through early detection as one of the main

technology integrations to help prevent the spread of COVID-19. As a result,

Cybersecurity, Internet of Things (IoT) along with artificial intelligence (AI)

is already being used to help predict future outbreak areas.

Leveraging WISeKey IoT-sensors equipped with the new WIShelter app capable of measuring temperature and providing geolocation of targeted quarantines, WISeKey’s technology can help mitigate the spread the coronavirus. Leveraging IoT, a network of interconnected systems, advances in digital certification, data analytics, AI and ubiquitous connectivity, WISeKey can provide an early warning system to curb the spread of infectious diseases.

In the Asia-Pacific region, China leads the way in IoT adoption (followed by Japan), and it is anticipated to spend $254.6 billion in IoT by 2025.

The simple answer might be for enterprises, cities, and national governments to collectively create a massive global network of sensors. Using the network of billions of interconnected smart IoT sensors we can detect the spread of viruses by combining the anonymized digital identity with the behavior of a person. However, this would require standardization, planning and implementation on a global scale and, a special focus on privacy, to complete the EWS. Lack of security increases the risk of users’ personal information being hacked while the data is collected and transmitted to the IoT device. IoT devices are connected with a consumer network, and sometimes unauthorized users might try to exploit existing security vulnerabilities, if the infrastructure is not properly secured.

EWS is a core type of data driven IoT system. The potential benefits of using a semantic-type EWS include easier sensor and data source plug-and-play, simpler, richer, and more dynamic metadata-driven data analysis and easier service interoperability and orchestration.

The IoT will live up to its promise only if the connected devices, the data they generate, the business applications that control these devices and the services around them, can be fully secured and trusted. In today’s environment, where cyberattacks have become more common and increasingly sophisticated, there is an urgent need to fundamentally rethink the Security Stack for the IoT cloud. IoT-enabled services and products will generate vast amounts of data which, when well-analyzed, will be very valuable to government organizations, product manufactures, corporations and end-users. Users can take advantage of this unique solution in the market by remotely being able to uniquely identify and control an IoT Edge Device (activation/deactivation/revocation), securely provision (point to point secure update) the IoT Edge Device credentials and secure the messages in motion between Edge Devices and Business Applications.

The first phase of the ultra-low-power Bluetooth 5 secure beacon implementation was developed using WISeKey’s VaultIC407, the RSL10 and N34TS108 temperature sensor from ON Semiconductor, as well as Tatwah’s BLE IT-005 IP68 class Beacon. The device has an outstanding battery life, with no compromise to security. The secure implementation allows replay attack protection, device clone protection, VaultIC absence detection, revocation capability, measurement validity check, and true temperature display.

The key to WISeKey’s growth strategy is the be the ubiquitous trust engine that powers the truly secure IoT through our unique and vertically integrated solutions combining leading software and hardware capabilities and leveraging integration and interoperability with other market leading companies and solutions.

First Half 2020 Operational Milestones:

- First Tapeout of our new 55nm CMOS Embedded Flash Secure Hardware platform, embedding a secure version of the RISCV core. This TapeOut is the first step of an R&D program which consists of developing the HW platform for WISeKey’s next generation of secure Elements, as well as building an IP offer for the semiconductors companies who want to embed a secure enclave in their SoC. The choice of the RISCV architecture was dictated by cost efficiency. The implementation of a flash memory, technology already implemented in our MS600X product, will allow us to reduce the development cycles of our customers, and to ease the customization of our products.

- First Production Volumes of VaultIC405 provisioned and delivered to PARROT through our VaultiTrust platform. VaultiTrust is the platform developed and operated by WISeKey in order to provide two services to our customers: the generation of trusted data (keys, certificates, unique ID) and the provisioning of the secure elements (VaultIC) at wafer level. The uniqueness of VaultiTrust is that it takes advantage of WISeKey’s government grade security certified offerings and end-to-end digital security management to generate identity keys and efficiently install them into chips. VaultiTrust’s web portal complements the service by offering an easy way to configure, manage and track production. WISeKey operates FIPS 140-2 Level 3 certified Hardware Security Modules (HSM) to efficiently generate secure data. These HSM are located in a WISeKey Common Criteria EAL5+ and ISO27001 certified backed up data center and the HSM can be shared only upon customer’s request.

- First prospects sampling our new NanoSealRT chips. NanoSealRT is a core part of the new NanoSeal® architecture developed by WISeKey which introduces the concept of Authentic Consumer Engagement, the combination of digital brand protection with simple to use consumer engagement options. NanoSealRT can be attached to any product to add supply-chain protection, and track and trace functions for sports apparel, cosmetics, wines & spirits, parcels, medicines and luxury goods. WISeKey’s NanoSealRT is the only NFC Forum Type 5 chip for tags which offers a patent-pending authentication algorithm based on NFC Data Exchange Format (NDEF) that works with both Android and IOS 12 devices, namely more than 2 billion NFC enabled devices. Its tamper/opening detection is a plus when it comes to enriching the consumer experience. The communication with the object is simplified from the manufacturing plant to the field thanks to a powerful ISO15693 compatible interface.

First Half 2020 Financial Milestones:

- Strong cash position: cash and cash equivalents together with restricted cash increased to $17.4 million at June 30, 2020, from $16.6 million at December 31, 2019.

- Substantially improved financial position has paved the way for significant investments in growth initiatives and strategic partners, such as that recently announced with Arago GmbH

- Investments in R&D: we continue to support our R&D work with $2.8 million invested during the year to develop new products and create business opportunities in cybersecurity, IoT, Microprocessors, Blockchain and AI.

- Revenue of $8.0 million: our revenues reduced year-on-year as compared to H1 2019 due to a combination of factors, with 2019 including some one-off revenues such as the sale of the ISTANA platform to a major car manufacturer, whilst 2020 was hit by the COVID-19 pandemic which resulted in delivery delays for several clients from H1 2020 to the second half of the year due to shutdown, whilst other deliveries were impacted by border restrictions. However, WISeKey’s enhanced position as a vertically integrated Identity Management/IoT/Blockchain service provider and “razor and blade: hardware and software” revenue model, has positioned us well to take advantage of massive opportunities in the market and return to increasing revenues and improved profitability.

- G&A Cost reductions: the Company incurred $2.0 million less G&A costs during the six months to June 30, 2020 as it made a conscious effort to reduce its expenditure and ensure that its cash reserves would support it through its Digital Transformation process.

Stock Price and Share Buyback Program

In early 2020, our stock price was negatively impacted by a number of factors, including:

- an overhang created by the expiration of the lockup period of shares issued for the acquisitions of VaultIC and QuoVadis;

- new shares issued through SEDA (Standby Equity Distribution Agreement) transactions which allowed WISeKey to obtain cash against issuance of new shares;

- payment of Exworks loan interest in shares; and subsequently exercise of warrants at 3 CHF

- low trading volume on the Swiss Stock Exchange for our category of stock; and,

- Technical issues on The Nasdaq platform and a mismatch between data vendors/ trading desks and prices reflected on various trading platforms created confusion, thus trading desks were unable to execute trades of our ADS.

Despite these issues our

share price somewhat has recovered in mid-2020 and the volume has increased in

both SIX and NASDAQ exchanges. We still

believe our current share price does not reflect WISeKey’s current operational

and financial performance, the value of its patents, proprietary technology,

nor its growth prospects.

WISeKey’s Products and Services

WISeKey continues to extend its leadership position in the global cybersecurity marketplace through the deployment of large-scale digital identity solutions that protect people and objects using Blockchain, Artificial Intelligence, and Internet of Things (“IoT”) technologies that respect the Human as the fulcrum of the Internet. With the combination of best-in-class secure silicon, certified software, and managed trust services, we have created Integrated Security Platforms that remove the complexities of protecting people and objects in the rapidly expanding connected world. For more information, visit www.WISeKey.com.

WISeKey delivers easy to use and robust security solutions to our clients who are creating innovative products that are driving the next age of digital transformation. We have an install base of over 1.5 billion microchips in virtually all IoT sectors including: connected cars, smart cities, drones, agricultural sensors, anti-counterfeiting tags, servers, computers, mobile phones, crypto tokens etc. With our VaultIC and recently announced NanoSealRT silicon at the edge of the IoT, where important decisions are being made, we play a significant role in the generation and protection of high-value authenticated Big Data that is being used for breakthrough applications like autonomous driving and predictive maintenance for industrial infrastructures.

Our platforms, trusted by the OISTE/WISeKey Swiss based cryptographic Root of Trust (“RoT”), ensure the integrity of transactions among objects people in both physical and virtual environments. Building from this foundation, we are uniquely qualified to deliver security applications like WISeID that provides individuals with enterprise-class digital asset protection in a mobile environment or our Managed PKI (“mPKI”) services that are built to scale with the high-volume demands of the IoT market and are ready to deploy with leading cloud platforms like AWS IoT Core.

In the complex world of cybersecurity, WISeKey cuts through the confusion of disconnected vendors, costly design teams, and architectural decisions that are riddled with security risks at every turn. When time, money, and reputation are all on the line we provide trusted solutions that allow our clients to focus on what they do best without worrying about their names being splashed across a front-page article trumpeting the latest device that was hacked and used to create a breach of consumer trust.

Recent Agreements

- ORACLE: WISeKey’S Blockchain Identity technology became one of Oracle’s first external trusted identity providers, allowing clients to securely add data onto the Oracle Blockchain Platform using the WISeKey cryptographic key infrastructure. Based on the relation established the respective teams implemented a prototype to secure IoT infrastructures combining the technologies such as the WISeKey Secure IoT Beacon operating transactions logged into the Oracle DLT digitally signed and such prototype will be showcased to promote as a secure IoT value proposition.

- CHINA: WISeKey’s Root of Trust accreditation by 360 Security Browsers to provide Trusted SSL Services in China reinforced its penetration in the Chinese technology market. Also, WISeKey’s comprehensive partnership with Long State Investment (LSI), a leading Asian based investor, aims to further expand the reach of WISeKey in the growing Asian markets. Under the arrangement, WISeKey and LSI plan to establish a Joint Venture in Hong Kong in the first quarter of 2020 to focus on business opportunities in Asia with financed by a $30 million facility provided by LSI during a 24-month period.

- WISEKEY BLOCKCHAIN CENTERS OF EXCELLENCE: In cooperation with the Blockchain Research Institute (BRI), WISeKey is creating a number of interconnected Blockchain Centers of Excellence around the world, to facilitate the rapid adaptation and on-boarding of blockchain-based solutions and foster stronger collaboration between the public, private and academic sectors. Each center purchases technologies and licenses from WISeKey.

- PATENT PORTFOLIO: Expansion with new IP and patents with the aggregation of 39 IoT / Semiconductors patent families (more than 200 patents in total) to its portfolio (https://www.WISeKey.com/patents/).

- WECAN Group: WISeKey creates synergies for the development of innovative solutions and brings secured identity and signature layer to existing Wecan business applications like compliance management, creating recognized standards and facilitating auditing and monitoring by regulators, and protecting the registration and protection of intellectual property of intangible assets worldwide. Wecan Tokenize (an asset tokenization platform). We jointly worked on the integration of WISeID Platform for WeCan Comply, WeCan Protect and shortly in WeCan Tokenize. WeCan Comply was selected by consortium of bank in the Canton of Geneva.

- E.A Juffali & Brothers, SAUDI ARABIA: Through the strategic partnership with SAT (a wholly owned company of E.A Juffali & Brothers), WISeKey will be deploying its cybersecurity services and IoT infrastructure in the Kingdom of Saudi Arabia and support its Vision 2030 economic reform plan, the Kingdom’s vision for the future. WISeKey Arabia has been completely settled and we are following a business development plan we are currently involved in a certain number of promising business opportunities on different stage from the sales cycle for both public and private sector. This includes large locals value added resellers on boarded.

2020 Growth Opportunities

WISeKey and arago joined forces to create the WISeAI joint venture:

WISeAI JV is the convergence of arago’s AI based Knowledge Automation and Data platform and WISeKey’s Cybersecurity and IoT technologies on a join platform with the name WISeAI.com

WISeAI Integrates semiconductors, smart sensors, IoT systems, Artificial Intelligence and a data cloud to deliver to customers a unique offering to power innovation and digital transformation. Using WISeKey’s cybersecurity technology and IoT network, data will be collected in HIRO where it can be processed and through automation acted upon in real time in a highly secure environment.

WISAI is the brain that will power the nervous system of the network of IoT objects operating in the WISeKey Ecosystem, which currently connects over 1.6 billion IoT devices secured with WISeKey’s VaultIC. With the introduction of 5G, the ecoSystem will continue to grow at a much faster rate as 5G will enable the connection of every object, person, and machine.

WISeAI embeds AI into the core infrastructure components of the EcoSystem including Root of Trust, semiconductors, and edge computing. Specialized APIs are then used to provide interoperability between components at the device, software and platform level to optimize system and network operations.

Data processed through WISeAI is then collected and made accessible to extract value and enhance market intelligence and knowledge for customers. WISeAI also enables secure automation of actions and business decisions based on real time data and enables IoT to work independently with minimal human support, unlike the current state of the market which requires that all actions be coded in advance based on pre-defined scenarios.

With the use of AI algorithms and predictive maintenance implemented through WISeAI, IoT devices will have the capability to dynamically determine actions to take decisions and self-program based on analytics and customer defined knowledge, resulting in lower operating and maintenance costs for providers.

IATA Relies on WISeKey for Digital Cargo Transformation:

IATA strengthens its partnership with WISeKey to secure their strategic digital cargo transformation, by adopting for production projects and integrating new stockholders such as Lufthansa and Ericsson. The implementation of the WISeKey technology enables highly secure authentication and data encryption by leveraging digital identity and Managed PKI Services, allowing the issuance of trusted digital certificates under its worldwide recognized RoT for the benefit of One Record and the entire Digital Cargo Trusted Ecosystem.

WISeKey Continues to Deliver Solutions While the Market Landscape is Shifting

The powerful portfolio of secure elements, including the long running VaultIC family is growing with the NanoSeal family added this year. NanoSeal embeds innovative features such as a one-tap Android & iOS compatible authentication algorithm, tamper/opening detection and long-range radio communication. These secure NFC tags are able to improve goods traceability and enhance direct-to-consumer digital strategies. The expanded portfolio acts as the foundation for many of WISeKey’s integrated and secure solutions empowering WISeKey to address new market verticals and most importantly to solve new business problems which keeps the solutions ahead of the turbulent markets which have been disrupted by the global pandemic.

Medical Devices:

With the disruptive changes in the health care sector, the privacy and protection of personal medical information has never been more important. Without ever going to the doctor’s office, patients are increasingly using remote medical sensors to gather diagnostics for doctors. The VaultIC family of products is the foundation for our integrated solutions being integrated into these remote diagnostic sensors to secure the authenticity of the device and ensure the protection of patient data and privacy. WISeKey is seeing growth with existing customers and new opportunities.

Product Life-cycle Blockchain:

During manufacturing, the quality of the output depends on the input materials and the processes used in production. WISeKey has partnered with a leading Blockchain platform to record the key phases of manufacturing in an immutable Blockchain. The project will use secure semiconductors to guarantee the authenticity and integrity for these Blockchain transactions:

- Authentic materials verification

- Manufacturing process integrity

- Quality assurance

This integration will provide immutable traceability for manufactures to demonstrate the quality and integrity of the products that they produce and is seeing applicability across numerous market verticals.

Certifications:

Secure semiconductors that are FIPS and Common Criteria certified are often required for government regulated applications. These regulated applications include Point-of-Sale terminals, secure radios, and medical equipment. As the demand for certified devices is increasing, WISeKey has an ongoing commitment to certify our devices to the latest standards. Having certified secure semiconductors allows manufacturers to achieve certification for their regulated products.

As the Market Evolves, WISeKey has Significant Market Opportunity

Digital Transformation:

The need for our customers to find new and innovative ways to connect with their consumers and remain relevant is at the heart of the world’s Digital Transformation. Our WISeAuthentic platform combined with the impressive cost and connectivity levels of the NanoSealtags allows us to deliver a wide array of solutions that help customers to efficiently exceed their Digital Transformation goals. Brands are spending millions to research and increase their marketing in an effort to stay connected with customers and the WISeKey solutions can transform their products and goods into digital platforms which provide valuable data to the customer and help to build their consumer network. These data can be used to develop more pointed marketing campaigns, provide one-touch ordering, promote geo-location-based messaging and so much more.

Brand Protection and Consumer Engagement:

As Brands reduce their brick and mortar presence and continue to evolve their ecommerce strategies and reach, authentic products and goods coupled with innovative ways to digitally connect with their consumers and drive their brand image and loyalty have never been more important. With the advent of the NanoSeal family being integrated with our PKI and Digital Identity solutions in concert with a strong partner ecosystem, WISeKey can now fully address the digitally connected needs of Brands bringing not only certainty to the authenticity of their products and goods, but also certainty to the consumer that they can engage with the brand in a completely secure way with a simple tap of their mobile device. This achieved by taking traditionally passive and non-connected products and goods and digitally enabling them with connectivity that the consumer can leverage, allowing the Brands to further develop their digital presence and build a digital community of interconnected consumers driving revenues, consumer confidence and brand loyalty.

Luxury Goods:

WISeKey has enjoyed our relationships with luxury brands like Hublot, BVLGARI, and FAVRE-LEUBA for over a decade now as we provided them with exclusive engagement platforms that took advantage of our secure silicon and PKI services embedded inside of watches and VIP cards. Coupled with the new approach to Brand Protection and Consumer Engagement and taking advantage of our WISeAuthentic platform which has been deployed in over 1 million watches already, WISeKey provides the next generation digital experience in an industry where value is perceived through tradition, heritage and craftsmanship.

IoT:

The ever growing IoT in combination with the now explosive growth in ecommerce is driving the need for secure devices and connected products. This opportunity is across almost all market verticals with different approaches and WISeKey is perfectly positioned with their solution portfolio to address all of the business needs. From the automotive space where secure devices and secure communications are critical to the medical device world which was discussed above to home security, the confidence that devices are secure and the data is trusted is paramount to success. One more recent example is WISeKey integrated with drones to sure the device and provide the platform for traceability.

WISeKey’s Foresight Platform: our combined value proposition

- HOLISTIC APPROACH TO DIGITAL IDENTITY: WISeKey’s strength and differentiation against competition comes by our capability to provide the whole technology stack to secure the identity and interactions of people, applications and objects. The ForeSight platform brings all required technology to deliver digital identities, embed those identities securely into IoT Devices thanks to WISeKey’s secure microcontrollers and secure the authentication and data of all intervenient (people, applications and objects) in these secure transactions. Platforms will continue to win as more and more companies look to add digital features to their products and WISeKey is perfectly positioned to take advantage of this market shift, thanks to its unique capability to combine secure hardware with security software and services.

- FIRST DELIVERY; ForeSight PKI: As a firstmodule of the Foresight platform, WISeKey has built a new Cloud PKI (“PKI”) platform that can serve the needs of both traditional digital certificates (Personal or SSL certificates) and new business needs for IoT Certificates, consolidated in a single architecture of micro-services. This platform is used by WISeKey to deliver Cloud Managed PKI services, but it can be also deployed on-premises for customers having special needs. The ForeSight PKI platform integrates with third party Cloud services, like Amazon’s AWS IoT Core.

- CUSTOM SOLUTIONS: WISeKey continues to evolve it’s offering of customizable security solutions like WISeArtchitect, WISeDeveloper, and WISeDesign that put over 40 years of security experience in the hands of our customers with our full support to help them build the right security solutions for their needs., Those custom solutions can be plugged into and enrich the ForeSight platform.

As one of the building blocks for the ForeSight Platform, WISeKey reinforces it’s offering for Personal and Corporate Digital Identity Protection through:

- NEW SERVICES FOR PERSONAL & CORPORATE IDENTITY: WISeKey continues to evolve its offering for personal identity and it’s launching new digital onboarding capabilities to facilitate the on-line validation of the identity and enable the issuance of advanced digital certificates valid for legally binding digital signatures. These new capabilities for remote enrollment will enable soon new B2C and B2C commercialization channels for WISeKey, like the online sale of personal identities from an eCommerce solution linked to WISeID.

- WISeCloud, THE WISEID CLOUD SERVICES PORTFOLIO: WISeKeycontinues to evolve its cloud services offering to leverage the WISeID account, and in particular to put in value the mPKI services with capabilities like WISeID CloudSigning to enable electronic signatures of documents into the business processes. Additionally, WISeID proposes a “Personal Encrypted Cloud” (WISeID Vault) that allows the users to keep their confidential information and documents protected in a “data safe” in their mobile devices and synchronized in a cloud storage in Switzerland.

- WISeApps, THE WISEID MOBILE APP ECOSYSTEM: The WISeID account is enhanced with mobile applications that enable specific capabilities and leverage the mPKI services. These applications, like “My WISeID” and “WISeID Vault” are already available and widely adopted. Related to the new pandemic and the technology needs that it’s triggering, WISeKey is launching two new mobile applications: WIShelter, that implements a “Health Card”, that can integrate the user health status and digitally signed documents (e.g. infection test results, vaccination proofs, etc); and WISeTravel, which combines the digital identity with the management of travel documents, carbon offsetting and health passport capabilities.

Recognitions

- ISO 27001 and ISO 9001 certifications renewal

- VaultIC 420: FIPS CMVP 140- Level2 certification

We have developed a VaultIC Secure Element version (the VaultIC 184) in accordance with the specification of Sigfox Network. The VaultIC184 is designed for encrypting the payload transmitted by a Sigfox enabled device (the edge device) through the Sigfox communication network.

The VaultIC184 is delivred with a Development Kit, containing a set of APIs thought and designed by WISeKey for facilitating the integration by the system integrators of the VautIC184 SE into the host MCU of the edge device.

The complete solution (VauTIC184 and the APIs) were tested and certified by SIGFOX R&D lab: Sigfox Verified™(referenced S_0003_8A25_01)

You can find a link on Sigfox website (https://partners.sigfox.com/companies/wisekey)

- WebTrust for Certification Authorities, Baseline Requirements and Extended Validation SSL services

Management Discussion and Analysis of Financial Condition and Results of Operations

FY 2020 Key Financial Milestones:

The key highlights of the year ended June 30, 2020 were:

- Strong cash position: cash and cash equivalents together with restricted cash increased to $17.4 million at June 30, 2020, from $16.6 million at December 31, 2019.

- Substantially improved financial position has paved the way for significant investments in growth initiatives and strategic partners, such as that recently announced with A.I. specialist, arago GmbH

- Investments in R&D: we continue to support our R&D work with $2.8 million invested during the year to date to develop new products and create business opportunities in cybersecurity, IoT, Microprocessors, Blockchain and AI.

- Revenue of $8.0 million at an improved margin of 41.4%: our revenues reduced year on year against H1 2019 due to a combination of factors, with 2019 including some one-off revenues such as that relating to the sale of the ISTANA platform to a major car manufacturer, whilst 2020 was hit by delays to deliveries as a result of the COVID-19 pandemic with several clients delaying their deliveries into H2 2020, whilst others were impacted by border restrictions. However, WISeKey’s enhanced position as a vertically integrated Identity Management/IoT/Blockchain service provider and “razor and blade: hardware and software” revenue model, has positioned us well to take advantage of massive opportunities in the market and return to increasing revenues and improved profitability.

- G&A Cost reductions: the Company incurred $2.0 million less G&A costs during the six months to June 30, 2020 as it made a conscious effort to reduce its expenditure and ensure that its cash reserves would support it through its Digital Transformation process.

Impact of the COVID-19 pandemic

The Covid-19 global pandemic had an impact upon the Group’s first half results. Although initially the Group did not see a reduction in demand for its products, as the pandemic evolved and more countries around the world implemented partial or full lockdown orders, some of its clients looked to defer delivery. In particular, deliveries to clients in certain countries became impossible due to the controls imposed on imports by governments, whilst other clients in sectors such as the retail sector looked to delay their orders.

The Group did receive support from the Swiss government in the form of two long-term loans and also received funding under the Swiss partial unemployment support. The strong reserves of the Group, combined with agreements by Senior Management and the Board to defer part of their salaries, meant that the Group has not had to make any reductions in force as a result of the pandemic. Currently the Group is claiming support for a relatively small proportion of its workforce based upon the reduction in work in Geneva, whilst the remaining parts of the Group remain fully employed.

It is impossible to predict the full extent of the impact of the COVID-19 pandemic but the Group remains confident that it has sufficient cash reserves to ensure that it will be able to continue to operate for the foreseeable future.

Key Performance Metrics

A summary of the key performance metrics of the Group is set-out in the table below:

17.4

16.6

Liquidity and Capital Resources

Cash and cash equivalents together with restricted cash at June 30, 2020 were $17.4 million, compared to $16.6 million at December 31, 2019. As mentioned earlier and as discussed throughout this document, Management have taken positive action to reduce costs in the wake of the COVID-19 pandemic which has, in turn, enabled the Group to maintain a healthy cash reserve. The Group have negotiated a new facility with Nice & Green SA as well as revising existing facilities with Yorkville Advisors Global LLC to maintain the cash balance and is well placed to use its funds to support the Group through the COVID-19 pandemic, to implement its Digital Transformation plan and to make strategic investments.

The Group have reviewed their

projections in detail and believe that they currently have sufficient funds to

carry them through to the end of 2021. The Group continues to have funding

arrangements in place with GEM LLC, Long State Investment and Yorkville

Advisors Global, LLC in addition to its facility with Nice & Green SA. These facilities provide the opportunity to

draw down up to CHF 136.6 million and, when combined with the net cash position

following the sale of the QuoVadis Group, provide further assurance regarding

the future operations of the business.

Revenues

For six months to June 30, 2020, WISeKey’s total revenue from continuing operations was $8.0 million. This compares to half-year 2019 revenue from continuing operations of $12.5 million. The revenue from continuing operations decreased by $4.5 million or 36% when compared to the prior period. This is mostly attributable to the following factors:

- The impact of the COVID-19 pandemic, as explained earlier, has led to a reduction of approximately $1.1 million through deliveries delayed at the request of clients. It is expected that these deliveries will be made in the second half of 2020, and $0.4 million has already been delivered in July.

- Our IoT activity was adversely affected by the overall downturn in the semiconductor industry worldwide, itself related to the COVID-19 pandemic. This downturn has affected all IoT and microprocessor companies with the Semiconductor Applications Forecaster from International Data Corporation forecasting a 7.2% decline in the non-memory semiconductor market.

- Some clients in the Semiconductor business have moved away from chip-based solutions as products reached the end of life and implemented software-only solutions. We have seen increases in revenue relating to some clients who had significantly reduced their demand in 2019 and we are anticipating strong demand in 2021 from certain key clients.

With the introduction of the Nanoseal family, the next-generation family of secure memory chips, we are positioning our product offering for the next technological evolutions. However, the performance of our IoT segment will remain dependent on the macro-economic factors impacting the semiconductors industry, particularly the ongoing Coronavirus pandemic and the impact this has upon the overall economy.

Revenue by region

Our operations are global in scope and we generate revenue from selling our products and services across various regions. While our operations in Europe have historically contributed the largest portion of our revenues, the revenue generated from North America shows our engagement in this region. We are also building a strategy to expand into new territories in Asia but this has been delayed as a result of the COVID-19 pandemic and the restrictions this has placed upon global travel.

Our revenue from continuing operations by geographic region for the six months ended June 30, 2020 and 2019 is set forth in the following table:

In Europe, the decrease in revenue is attributable to some non-recurring 2019 revenue generated from the support surrounding the sale and installation of the ISTANA platform of $0.4 million whilst the rest of the decrease is linked to reductions in demand from our clients as they suffer from the downturn in both the wider semiconductors industry and in specific client industries, such as the luxury watch industry.

The share of revenue from clients in North America has increased at 54% in 2020 compared to 43% in 2019. However, our US portfolio has still been impacted by the downturn in the semiconductors industry. Whilst our market share with our key clients remains largely unchanged against 2019, the level of orders in the first half of 2020 was significantly reduced. In-line with the Group’s Digital Transformation Plan, we anticipate our North American revenue to increase in 2021 and beyond as we invest in our North American sales team and develop our sales strategy.

Gross profit

Our gross profit from continuing operations decreased by $1.5 million to $3.3million (but with a gross margin increase to 41%) in the six months ended June 30, 2020 in comparison with a gross profit of $4.9 million (gross margin of 39%) in the six months ended June 30, 2019. The slight improvement in our gross margin despite the reduction in revenues is as a result of the products that had been phased out having lower gross margins than the newer products. We anticipate the margin continuing to improve as sales will remain focused on the newer, high margin products.

Net Income

Despite the reduction in turnover, the Group’s operating loss reduced by $0.6 million or 8% to $7.3 million in the six months ended June 30, 2020 as compared to $7.9 million in the six months ended June 30, 2019. This was principally due to reductions in operating expenses year on year, particularly with regards to our general and administrative expenses.

The WISeKey Group continues to show a relatively heavy cost structure due to its investment strategy and new and innovative lines of business, such as Blockchain, Artificial Intelligence and its Digital Transformation Program. The sections below on the operating expenses provide additional details.

Analysis of operating income and expenditure

Total operating expenses from continuing operations reduced by 17% or $2.1 million, from $12.7 million to $10.6 million, largely as a result of the Group’s aim to reduce its overhead costs. Most of this decrease relates to the reductions made in the Group’s General & Administrative expenditure being, in particular, a major reduction in our legal and professional fees and our travel expenses as a result of lower M&A activity due to the COVID-19 pandemic and the associated restrictions.

Other operating income

In 2020 our other operating income consisted of recharges for the use of our premises by OISTE (see Note 34 of our consolidated financial statement as at December 31, 2019), whilst the prior year included a gain on the liquidation of our subsidiary WISeKey Italia s.r.l $24,000.

Research & development expenses

Our research and development (“R&D”) expenses includes expenses related to the research of new technology, products and applications, as well as their development and proof of concept, and the development of further application for our new and existing products and technology, such as VaultiTrust, WISeID, and NanoSealRT. They include salaries, bonuses, pension costs, stock-based compensation, depreciation and amortization of capitalized assets, software licenses, costs of material and equipment that do not meet the criteria for capitalization, as well as any tax credit relating to R&D activities, among others.

Our R&D expenses represented respectively 26% of total operating expenses in 2020 as opposed to 21% in the six months ended June 30, 2019. Our Group being technology-driven, this reflects our engagement to act as a leader in new cybersecurity developments and future applications. The absolute expenditure on R&D increased by $130,000 in the six months to 30 June 2020, reflecting additional resources focused on the development of the WISeTravel and WISeID applications in Geneva.

Selling & marketing expenses

Our selling & marketing (“S&M”) expenses include advertising and sales promotion expenses such as salaries, bonuses, pension costs, stock-based compensation, business development consultancy services, and costs of supporting material and equipment that do not meet the criteria for capitalization, among others.

Our S&M expenses decreased by 8.5% or $0.2 million in the six months ended June 30, 2020 compared with 2019. Of this reduction, $51,000 is explained by the restructuring of our sales force in Europe and North America with two members of our sales team, one in North America and one in Europe, having left the Group in H2 2019 and only being replaced in late H1 2020. The remaining reductions were as a result of the restrictions caused by the COVID-19 pandemic, with a reduction of $170,000 in travel and entertainment expenditure and a further reduction of $157,000 in advertising and promotional spend. The S&M expenditure is expected to increase again in H2 2020 as the Group invests in its sales team to support its return to growth and, hopefully, as the effect of the pandemic diminishes and the global economy starts to return to its prior state.

General & administrative expenses

Our general & administrative (“G&A”) expenses covers all other charges necessary to run our operations and supporting functions, and include salaries, bonuses, pension costs, stock-based compensation, lease and building costs, insurance, legal, professional, accounting and auditing fees, depreciation and amortization of capitalized assets, and costs of supporting material and equipment that do not meet the criteria for capitalization, among others.

Our G&A expenses decreased by 29% or $2.0 million in the six months ended June 30, 2020 compared with the same period in 2019. This decrease is due to a conscious effort to reduce our overhead expenditure. Our expenditure on legal and professional fees reduced by $1,055k against the prior period reflecting the savings made following the simplification of our legal structure and the sale of QuoVadis, as well as a significant reduction in the ongoing level of external legal and consultancy spend as we bring as many of these activities in-house as is possible. Our staff costs reduced by $233,000 due to a reduction in the number of G&A staff as well as the credits received from the Swiss government for partial unemployment claims following the COVID-19 pandemic alongside a $120,000 reduction in travel and living costs due to the travel restrictions imposed in the first half of 2020. Board fees also reduced by $265,000 year on year due to a one-off charge included in the prior year relating to the payment of the stock options relating to the previous years. Finally, non-income tax expenditure reduced by $185,000 principally due to the previous year including a one-off stamp tax relating to the transfer of our French R&D team to a new legal entity as part of a strategic restructuring to create a Group R&D function based in France.

The main components of our G&A costs are detailed below:

We expect our G&A expenses to remain lower in the second half of 2020 as we continue to apply tight controls over our controllable costs in the wake of the COVID-19 pandemic. In future periods, however, we would anticipate that these costs would increase to support our growth and strategical positioning. Anticipated costs include those relating to:

- Our expansion strategy with potential acquisitions will maintain high legal, auditing and accountancy, and other professional G&A costs;

- Employee Stock Option Plan: grants to support our staff retention strategy will impact all cost categories including G&A

- To preserve the flexibility of our local entities, many of our staff are involved in projects covering sales & marketing, R&D and general and administrative fields. Where the allocation is not straightforward, these staff have been included entirely in G&A expenses.

Non-operating income and expenses

Income and expenditure resulting from non-operating activities increased by $369,000 in the six months ended June 30, 2020 compared with the same period in 2019. The main reason for the reduction is contained within the non-operating expenses and non-operating income.

Our non-operating income decreased by $814,000 principally due to reduced foreign exchange gains. This was offset by a similar reduction in our foreign exchange losses of $646,000 that forms part of the reduction in our non-operating expenses of $184,000, with the offset being due to the aforementioned reduction in the market value of our investment in OpenLimit, a provider of certified software for electronic signatures and identities with its registered office in Baar, Switzerland, which reduced by $434,000 in the period to June 30, 2020 compared to a small increase of $44,000 in the prior period.

The prior year included a one-off loss of $233,000 on the extinguishment of the ExWorks Credit Facility, incurred upon repayment of the facility. This was offset by increased interest charges and debt discount amortization resulting from the charges relating to new facilities with Yorkville LLC and Crede Capital LLC, as well as the new loan taken out with ExWorks in April 2019. These facilities created an increase in interest expenditure and amortization of debt discounts of $184,000.

Finally, the company made a gain on derivative liabilities of 44,000 during the six months to June 30, 2020 in comparison to a loss of $80,000 in the same period last year. This is due to changes in the valuation of the derivative based upon the share price of the Group using a binomial lattice calculation.

Our Company regularly enters into loan and convertible loan agreements to finance its operations.

Outlook for H2 2020 and beyond

We have taken several initiatives to generate new revenue sources, grow our client base, increase awareness and expand our geographic footprint.

These initiatives include:

- Strategic investment in ARAGO GmbH and the launch of a Joint Venture, WISeAI representing the convergence of ARAGO’s AI based Knowledge Automation and Data platform with WISeKey’s Cybersecurity and IoT technologies on a joint platform.

- Launch of new proprietary solutions, including VaultiTrust, WISeID, and NanoSealRT: offering secure digital identities for critical applications such as smart grids, cloud security, drones, smart homes, Industry 4.0, consumer engagement, personal asset protection, anti-counterfeiting, and battery protection

- Development of modular Integrated Security Platforms that meet the need for easy to deploy security solutions that can be reconfigured to solve the unique challenges of market verticals

- Establishment of several partnerships with leading players in the Identity Management/IoT/Blockchain segment, together with joint ventures in Saudi Arabia and India which will provide new revenue streams and increased diversification

Non-GAAP Financial Measures

In managing WISeKey’s business on a consolidated basis, WISeKey management develops an annual operating plan, which is approved by our Board of Directors, using non-GAAP financial measures. In measuring performance against this plan, management considers the actual or potential impacts on these non-GAAP financial measures from actions taken to reduce costs with the goal of increasing our gross margin and operating margin and when assessing appropriate levels of research and development efforts. In addition, management relies upon these non-GAAP financial measures when making decisions about product spending, administrative budgets, and other operating expenses. We believe that these non-GAAP financial measures, when coupled with the GAAP results and the reconciliations to corresponding GAAP financial measures, provide a more complete understanding of the Company’s results of operations and the factors and trends affecting WISeKey’s business. We believe that they enable investors to perform additional comparisons of our operating results, to assess our liquidity and capital position and to analyze financial performance excluding the effect of expenses unrelated to operations, certain non-cash expenses related to acquisitions and share-based compensation expense, which may obscure trends in WISeKey’s underlying performance. This information also enables investors to compare financial results between periods where certain items may vary independent of business performance and allow for greater transparency with respect to key metrics used by management.

These non-GAAP financial measures are provided in addition to, and not as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. The presentation of these and other similar items in WISeKey’s non-GAAP financial results should not be interpreted as implying that these items are non-recurring, infrequent, or unusual.

Non-GAAP to GAAP Reconciliations

(Million US$)